This article is written by Matthew Swiggs, a Chartered Financial Planner and Fellow of the Personal Finance Society. As an associate member of Resolution, Matthew works for Benchmark Financial Planning, part of the Schroders Group, helping clients navigate financial decisions during divorce with clarity and confidence.

Can You Afford to Keep the Family Home? Cashflow Planning Can Tell You

As proud members of Resolution and the Collaborative Family Solutions POD, we follow a constructive, respectful, and collaborative approach to financial planning during divorce. Our work supports families in making informed, sustainable decisions with minimal conflict, in line with Resolution’s Code of Practice.

Divorce is a significant life change, and one of the biggest questions people face is: Can I afford to keep the family home? This is where cashflow planning can help. It provides clarity, confidence, and control – helping you understand your financial future and make informed decisions.

What is Cashflow Planning?

Cashflow planning is a powerful tool used by financial planners to provide clarity and confidence during divorce settlements. It offers a clear visual of your financial situation and can be used in two ways:

- Personally – to help individuals understand their own financial future.

- Impartially – to support fair division of assets during negotiations.

How Does It Work?

Visualising Your Financial Future

A cashflow model projects income, expenses, assets, and liabilities over time, helping individuals understand their financial position now and in the future.

Assessing Settlement Sustainability

It helps evaluate whether proposed settlements – such as keeping the family home or receiving a pension share – are financially viable long-term.

Determining Support Needs

Cashflow planning can assess the affordability and sustainability of spousal or child maintenance payments for both parties.

Reducing Conflict

By providing objective, data-driven insights, cashflow planning reduces emotional decision-making and supports more amicable negotiations.

Planning Beyond Divorce

Following the final order, cashflow planning helps prepare for future goals such as retirement, investment management, or the sale of a family home.

What Does It Look Like?

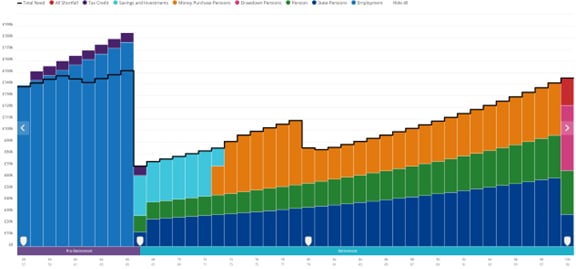

A typical cashflow plan is presented as a clear, visual chart showing your projected income, expenses, and assets over time. It is important to note that these plans are based on assumptions and are adjusted throughout the years to accommodate changes in legislation, cost of living, and changes in the client’s circumstances.

Why It Matters

Cashflow planning empowers you with:

- Clarity – Understand your financial future year by year.

- Confidence – Make informed decisions about settlements and future plans.

- Control – Explore different scenarios like downsizing or delaying retirement.

Frequently Asked Questions

Is cashflow planning accurate?

It’s based on realistic assumptions and updated regularly to reflect your changing circumstances.

When should I start?

Ideally before settlement negotiations begin, so you can make informed choices.

Does it replace legal advice?

No. It complements legal advice by providing financial clarity to support your decisions.

Final Thoughts

Cashflow planning is more than just numbers on a page – it’s about giving you clarity and confidence at a time when life feels uncertain. By combining this powerful tool with a collaborative approach, we help reduce conflict, support constructive conversations, and keep the focus on what truly matters: creating a fair, sustainable financial future for everyone involved.

When you can see your options clearly, you can make decisions with confidence – and move forward with peace of mind.